Deductions can be applied throughout various sections of Vault, including pre-distribution deductions, agent deductions and agent expense deductions. More information on how to set up a deduction can be found via the Setting up Deductions knowledge article. Below is a step-by-step guide on how to apply deductions across the various sections within Vault.

Step by step

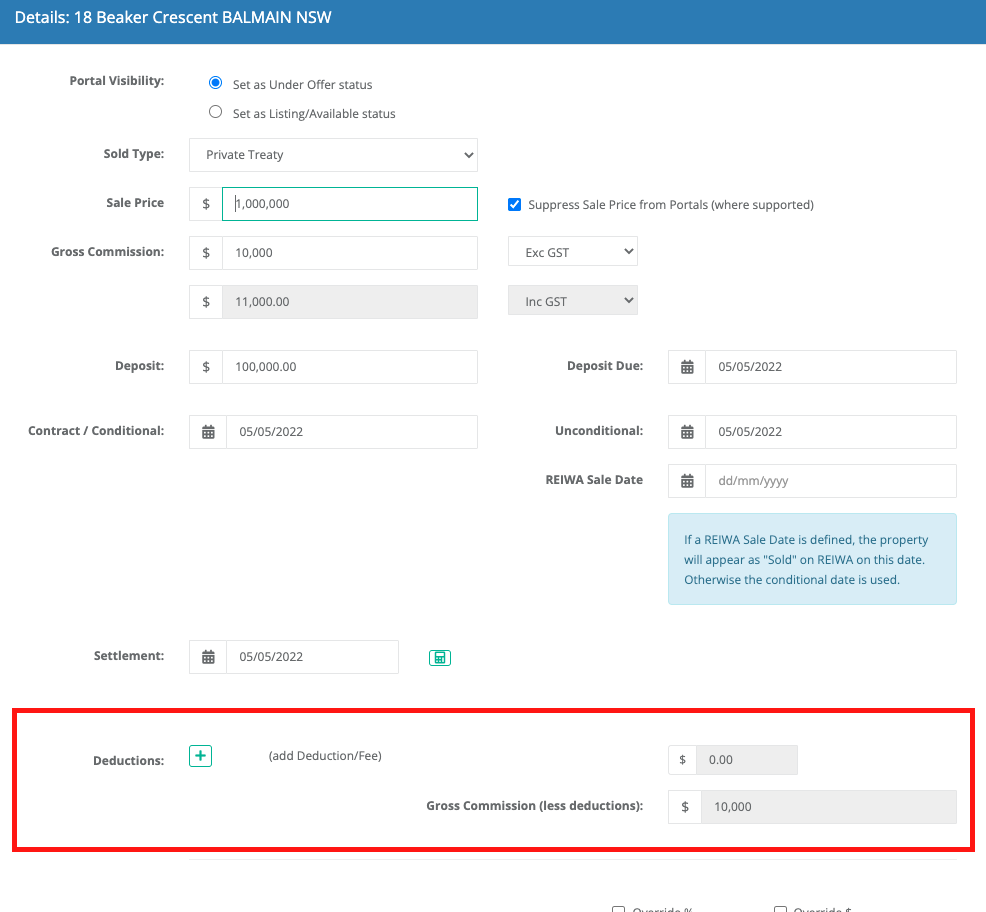

Applying pre-distribution deductions

We provide to option to activate pre-distribution deductions to apply during the sales process. This allows you to apply a deduction off the top of the total gross commission before the splits and agent allocation.

Pre-distribution deductions can only be activated upon request. Please speak to the support team to discuss this further.

1. Convert a listing to Conditional "Under Offer" status

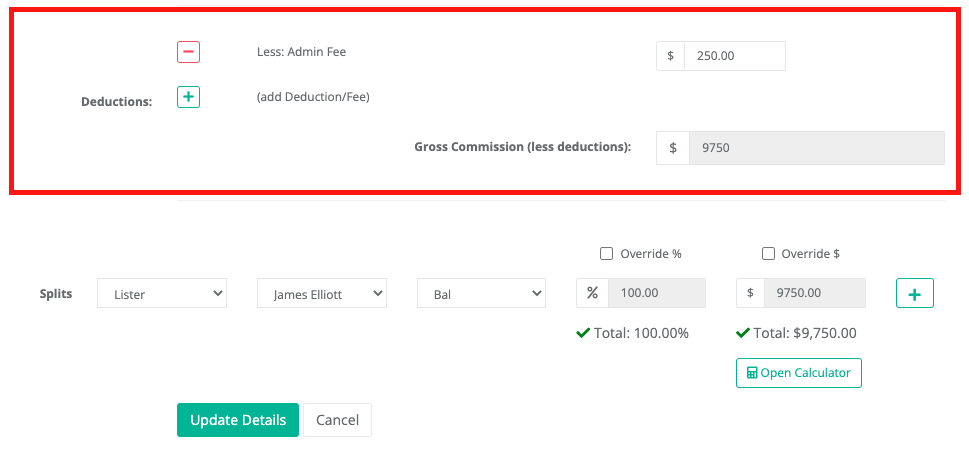

2. Once in the sales details, click on the plus (+) symbol under deductions

Examples of a deduction can be a referral, donation or settlement gift etc

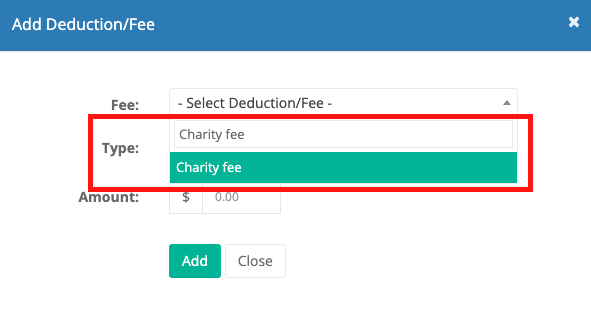

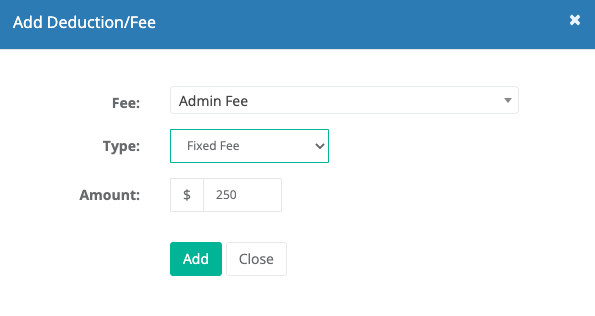

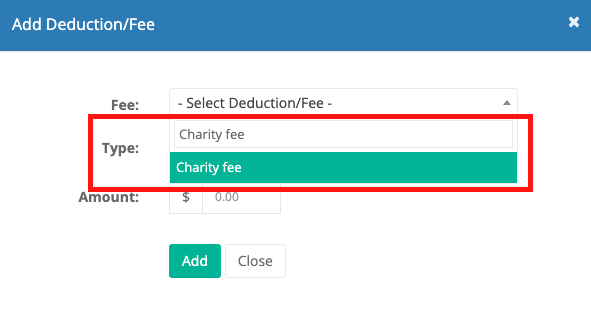

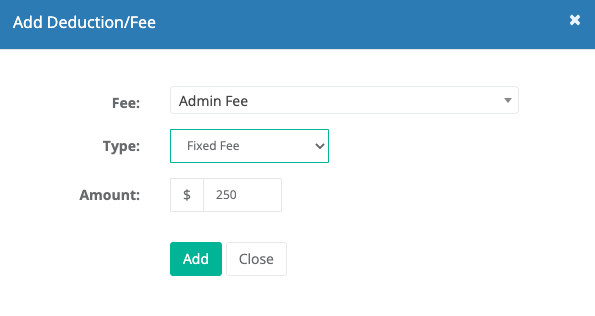

3. This will then open the Add Deduction/Fee screen, where you are able to add a new deduction via the freeform text field in the fee dropdown or select an existing deduction (type to search for existing)

4. If adding in a new deduction, populate the type (Fixed Fee or Percentage of the total commission) and the amount to apply

5. Once added, this will then apply the deduction against the total gross commission

Applying agent deductions

We provide the option to apply an agent deduction against the agents defined within the splits. These deductions are specifically taken off the total gross commission of the desired agents split.

1. Once a property has been converted to Conditional "Under Offer" status, navigate into the Financials tab > Agent Deductions tab > Click on the plus (+) symbol against the desired agent

2. This will then open the Add Deduction/Fee screen, where you are able to add a new deduction via the freeform text field in the fee dropdown or select an existing deduction

3. If adding in a new deduction, populate the type (Fixed Fee or Percentage of the total commission) and the amount to apply

4. Once added, this will then apply the deduction against the agent's gross commission split

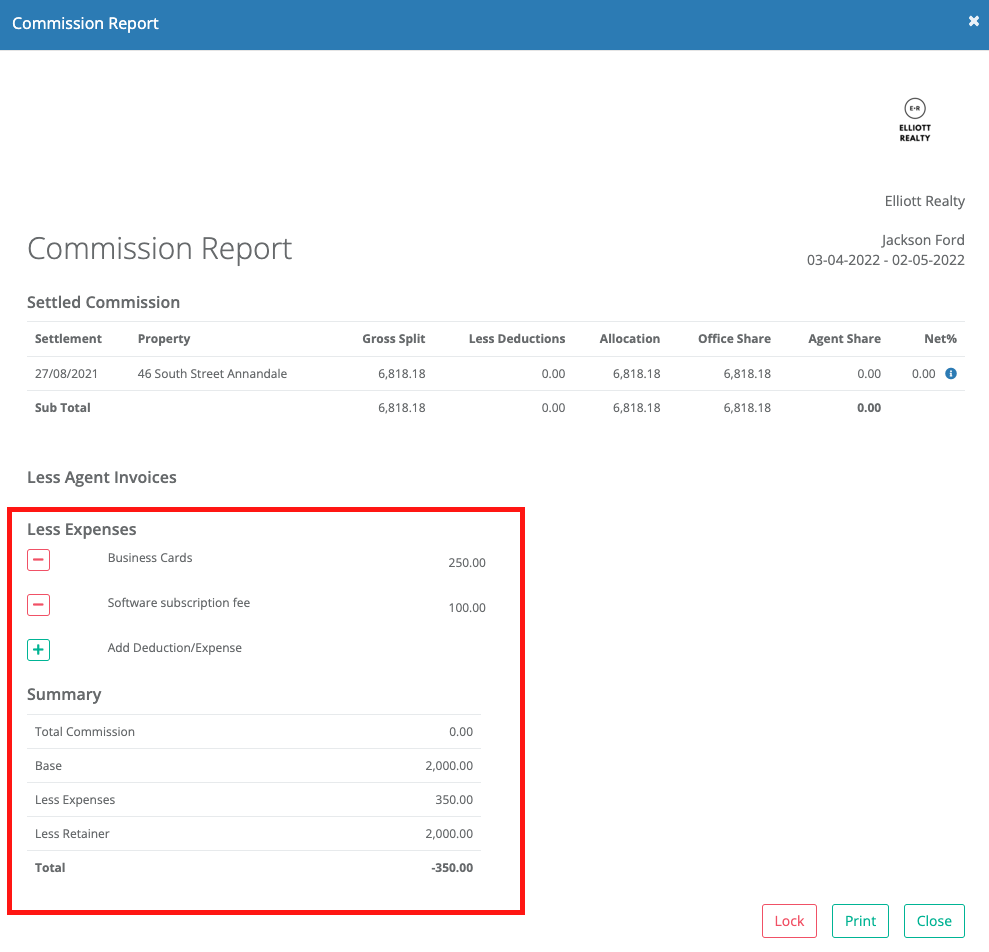

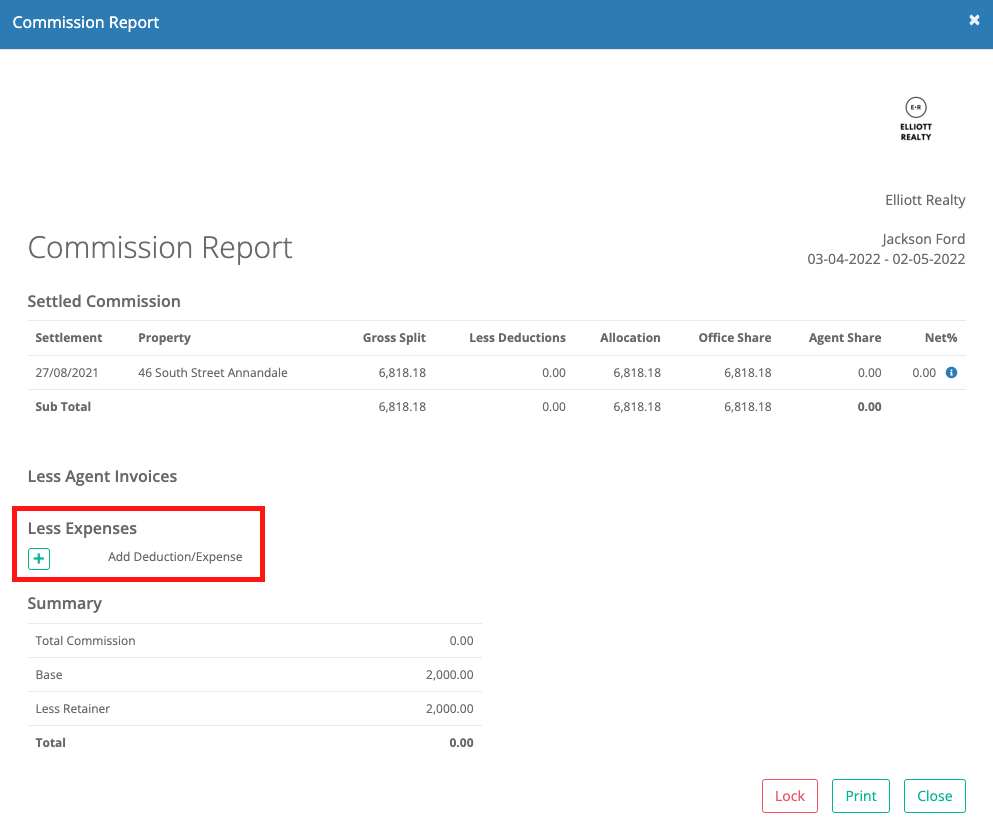

Applying an agent expense deduction within the agent commission report

We provide the option to apply a deduction against an agent's commission report. This can be used to apply a deduction against the agent's total commission. More information on this report can be found via the Commission (Pay Cycle Commission Report) knowledge article.

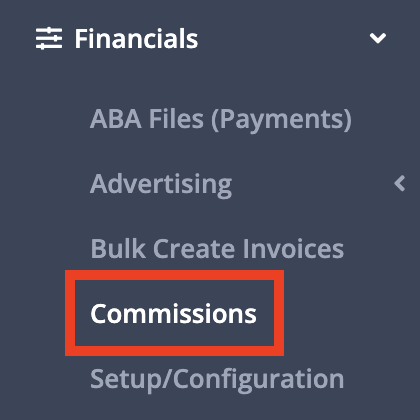

1. Navigate into Financials > Commissions

2. Open the commission report for the desired agent

3. Click on the plus (+) symbol under "Less Expenses"

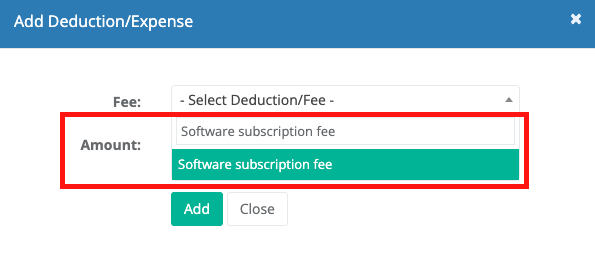

3. This will then open the Add Deduction/Expense screen, where you are able to add a new deduction via the freeform text field in the fee dropdown or select an existing deduction

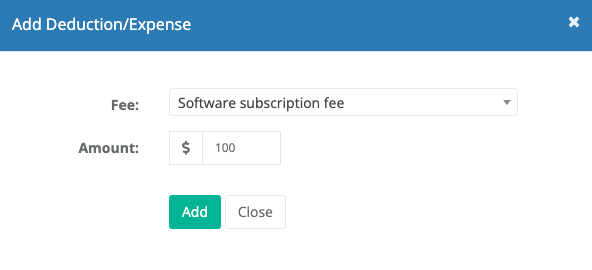

4. If adding in a new deduction, populate the amount to apply

5. Once added, this will then apply the deduction against the agents total commission